Pendle Weekly Report Overview: Pendle releases new Boros features and year-end airdrop plan, and vePENDLE users who lock up vePENDLE receive multiple income incentives

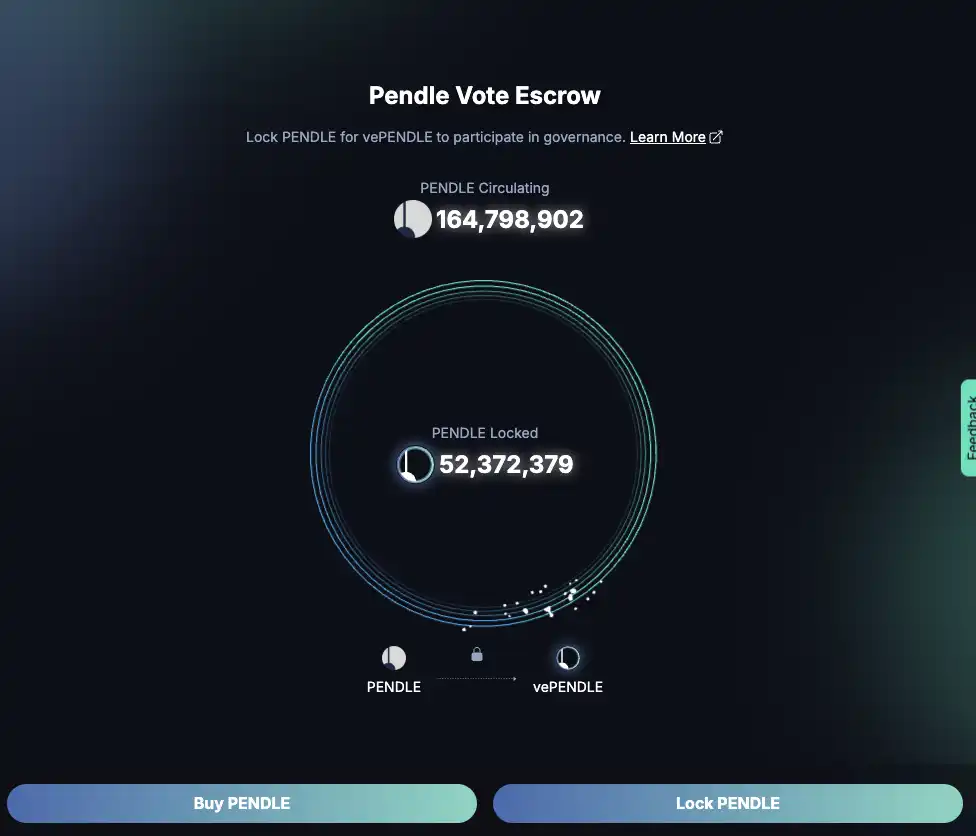

According to official news, since November 28, the Pendle platform has generated more than $1.15 million in fee income, bringing significant benefits to vePENDLE holders. Currently, about 30% of PENDLE tokens are locked as vePENDLE, and 80% of the fees generated by the platform are allocated to vePENDLE holders. The average lock-up time of vePENDLE reaches 388 days, further highlighting the long-term confidence of the community. The total amount of PENDLE in circulation in the market is currently 164,798,902, and the total amount of locked PENDLE is 52,372,379.

Users who support the appropriate funding pool for voting can enjoy an annualized rate of return of up to 4,399% (MUXLP pool). Additionally, users can increase their pool’s base annualized yield by 2.5x.

Pendle’s Upcoming Feature: Boros

Pendle will be launching a new feature next year, Boros. Boros (formerly Pendle V3) will support trading of new yield assets and introduce leverage through margin trading capabilities, enabling unprecedented capital efficiency on any yield type, including off-chain yields. This will provide users with more trading opportunities and a higher leverage trading experience, while increasing platform fee income, all of which will be distributed to vePENDLE holders.

With Boros, Pendle is opening the next major chapter in the yield space, starting with a critical but underdeveloped type of yield in crypto – funding rates.

Perpetual swaps exchanges trade $150-200 billion per day, and funding rates play a major role in shaping traders’ strategies. With Boros, traders will be able to trade funding rates with flexibility and precision, enabling previously unattainable levels of sophistication. This innovation will not only redefine Pendle’s product range, but is also expected to reshape one of the world’s largest and most active markets.

Boros introduces a completely new infrastructure that runs alongside the existing Pendle V2, which will continue to be optimized and improved. We envision a future where traders and market makers incorporate Boros as part of their core yield strategies.

For example, there is currently no reliable way to hedge funding rates at scale. Take Ethena as an example, the yield and sustainability of the protocol depends heavily on the volatility of funding rates, which often involve billions of dollars in notional capital. .

The emergence of Boros changes this situation, providing an active and capital-efficient solution that enables traders to achieve absolute control and predictability of returns. Taking Ethena as an example, they can get a fixed funding rate return by hedging on Boros. From another perspective, speculators can use leverage to trade the volatility of funding rates and obtain potential excess returns, unlocking a new strategy space in the interest rate dimension.

The funding rate is just one of many new starting points for Boros. With the synergy of Boros and V2, the Pendle ecosystem is going all out to redefine the framework of DeFi returns.

Year-end Airdrop Benefits

Pendle will launch a large-scale airdrop at the end of the year, and each vePENDLE holder will receive airdrop rewards based on the points collected by the protocol. The vePENDLE holding snapshot will be taken at 23:59 (UTC) on December 31, 2024, and the corresponding tokens will be distributed proportionally.

Please note that this airdrop is only for individual vePENDLE holders, and third-party liquidity lockers will not be included in the airdrop.

Tokens to be distributed include:

More tokens may be added before the snapshot date.

The accumulated income and points since the announcement of the Boros function will also be distributed to vePENDLE's liquidity lockers to further incentivize user participation.

Pendle is continuously improving its core competitiveness in the field of decentralized finance through rich functional upgrades, generous user incentive plans and innovative revenue models. Community members are welcome to actively participate, lock vePENDLE, and enjoy more benefits and benefits.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn